Family Law

Are you on the brink of divorce, overwhelmed and don’t know what to do next?

Want to keep your children out of the crossfire of family conflict?

Worried about how your legal problems will end and how much it will cost?

Estate Planning

Are you concerned about providing for your loved ones after your death?

Is it time to get serious about protecting your success and hard earned assets?

Want to eliminate the risk of family squabbles over your estate?

You deserve experienced attorneys who work hard to deliver a high level of excellence and value.

With Sapere Law, you can relax and eliminate the confusion, enjoy a legal team who “gets you,” and get onto a clear path through life’s most difficult moments.

With Sapere Law, you can ensure your loved ones and your future are protected, your legacy lives on, and the government stays out of your business.

Nancy Hankel

Robin Procetto

1. Schedule a Consultation

Your Sapere Law Attorney will spend 90 minutes listening to you, hearing your concerns and understanding your goals. You’ll leave with a heap of practical advice and a game plan for the very next steps you should take.

2. Retain the Firm

If both you and Sapere Law agree it’s time to take the next step, you’ll retain the firm through an agreement and a deposit. It’s that simple.

3. Meet Your Team and Launch Your Game Plan

When we become your lawyers, you’ll meet with us and get to know your personal legal team (yes, you get a team). We’ll work up the game plan, roll up our sleeves and get going. You leave your troubles at the door – that’s our job now.

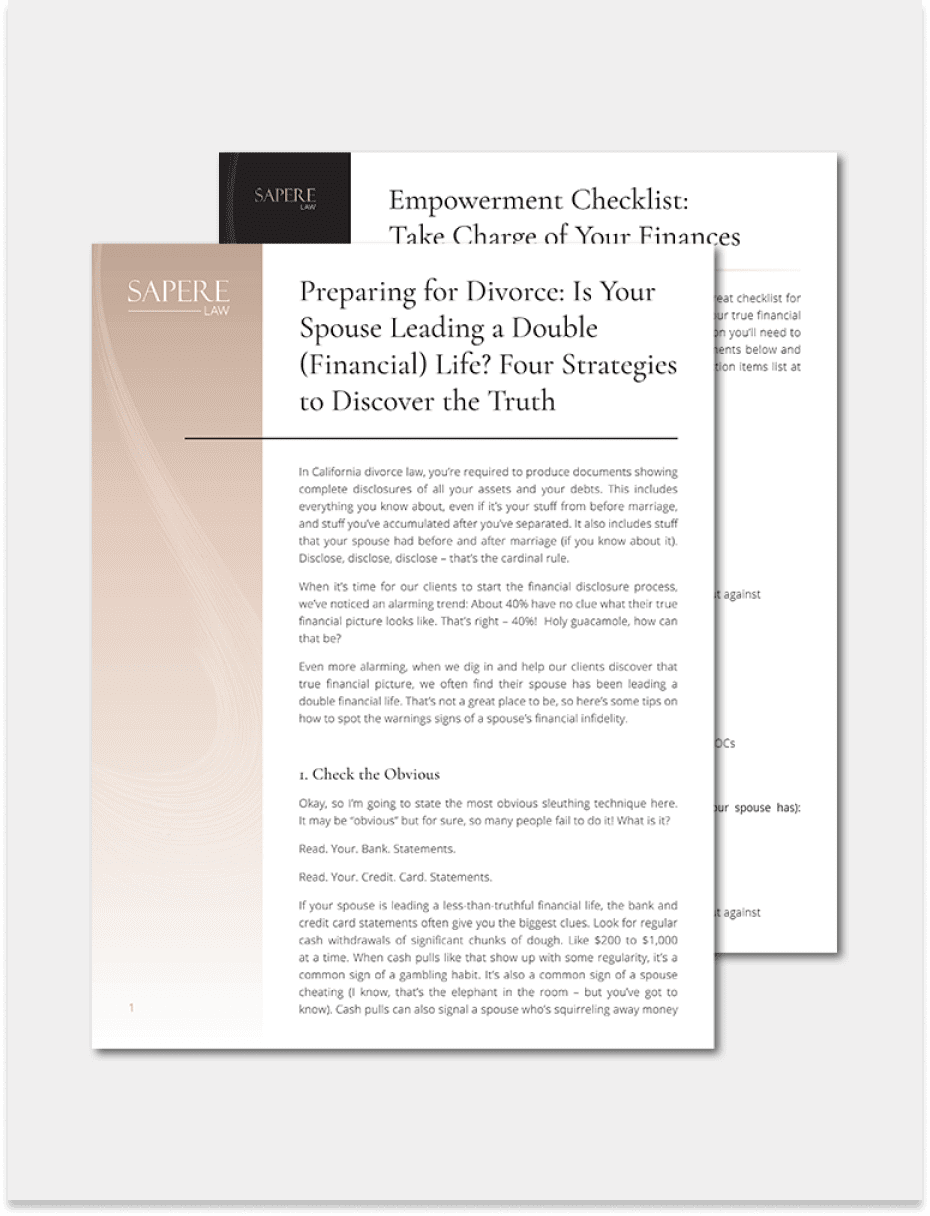

DOWNLOAD OUR FREE GUIDE:

Preparing for Divorce: Is Your Spouse Leading a Double (Financial) Life? Four Strategies to Discover the Truth

Here’s what you’ll learn:

How to spot the warning signs of hidden financial problems in your marriage.

What to look for in your finances, and where to find it.

You’ll get a powerful checklist to help you gather all the financial information you’ll need to take control of your financial future.

Download Our Free Guide:

Here’s what you’ll learn:

How to spot the warning signs of hidden financial problems in your marriage.

What to look for in your finances, and where to find it.

You’ll get a powerful checklist to help you gather all the financial information you’ll need to take control of your financial future.

Thank you! Here’s your free “Preparing for Divorce” guide, along with a helpful checklist to get things in order.